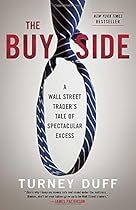

The Buy Side: A Wall Street Trader's Tale of Spectacular Excess

| Author | : | |

| Rating | : | 4.73 (973 Votes) |

| Asin | : | 0770437176 |

| Format Type | : | paperback |

| Number of Pages | : | 320 Pages |

| Publish Date | : | 2015-02-22 |

| Language | : | English |

DESCRIPTION:

Good description of one man's journey in high finance Srikumar S. Rao Duff writes well and I guess he would have done well if he had pursued his original ambition to be a journalist. Instead he took a detour into finance and landed up as a gofer on the trading floor in a well known investment bank. He worked his way up and eventually became a trader in his own right and discovered in himself skills that made him a good one. For example, he did not fall in love with any position he took and was quick to cut losses. He also had sound instincts about the direction the market would head and the steady nerves to bet big on this. So, in glory years, he made a lot of money for his. David Bahnsen said A Fourth Step Masterpiece. I will let you in a little secret (though I think I admitted this in my review of Wolf of Wall Street already … I will read any book and see any movie that comes out regarding life on Wall Street. I can know ahead of time that it is going to be cartoonishly stupid, and they often are, and I will still read or see it. Some are quite serious in nature (see my lengthy list of reviews covering the financial crisis of "A Fourth Step Masterpiece" according to David Bahnsen. I will let you in a little secret (though I think I admitted this in my review of Wolf of Wall Street already … I will read any book and see any movie that comes out regarding life on Wall Street. I can know ahead of time that it is going to be cartoonishly stupid, and they often are, and I will still read or see it. Some are quite serious in nature (see my lengthy list of reviews covering the financial crisis of 2008), and some are entertainment-driven (the Wolf of Wall Street is a case in point). Michael Lewis may be known to many of you for Moneyball and The Blind Side, but the book that made hi. 008), and some are entertainment-driven (the Wolf of Wall Street is a case in point). Michael Lewis may be known to many of you for Moneyball and The Blind Side, but the book that made hi. FROM THE PEOPLE WHO BROUGHT YOU THE 2008 FINANCIAL CRASH… Sandy Nathan Fantastic true story of one of Wall Street's finest. Gives an insider's (pun) view of the culture of Wall Street and why almost everyone in the US got stuck in 2008. Imagine a world where drugs and breaking the law are the norm. Well, this was a rough read. I hope Turney makes it. My husband commented that he almost quit reading it because he couldn't stand the "soaked in coke" lifestyle and self-destructiveness of the author/hero. That's true. But he's so honest in laying out what he did and doesn't blame others for what happened. Essential reading for anyone wanting to know what Wall Street is really li

After trying – and failing – to land a job as a journalist, he secured a trainee position at Morgan Stanley and got his first feel for the pecking order that exists in the trading pits. Those on the “buy side,” the traders who make large bets on whether a stock will rise or fall, are the “alphas” and those on the “sell side,” the brokers who handle their business, are eager to please. How eager to please was brought home stunningly to Turney in 1999 when he arrived at the Galleon Group, a colossal hedge-fund management firm run by secretive founder Raj Rajaratnam. Finally in a position to trade on his own, Turney was encouraged to socialize with the sell side and siphon from his new broker friends as much information as possible. Soon he was not just vacuuming up valuable tips but also being lured into a variety of hedonistic pursuits. Naïve enough to believe he could keep up the lifestyle without paying a price, he managed to keep an eye on his buy-and-sell charts and, meanwhile, pondered the strange going

So by the fall of 2008 I knew there was no end in sight. Conversely, when I was bottoming out, I constantly was saying to myself, “What happened?” The real danger comes when people start equating net-worth to self-worth.Q. The jig is up. At what point did you realize that, without help, you’d be unable to pull out of your downward spiral?A. There are a lot of guys whose careers have asterisks next to their earnings. Believe it or not, there are plenty of people with integrity on Wall Street. Why do you think the social aspect of Wall Street came so easy, and did it startle you when you realized that having a high social I.Q. could be more profitable than “reading the tape” or being a quant?A. Sure, we’ll still see some bad guy